BigCommerce has managed to maintain and even grow its presence due to regular updates and a slew of useful features, helping businesses grow with dynamic storefronts. But what does the bigger picture look like? How does BigCommerce’s market share shape up against its competitors, and how exactly are buyers responding to the platform’s latest updates? Get a closer look at the bigger picture with this Coalition Technologies stats overview.

Table of Contents

- 1 Sales Performance

- 2 User Demographics

- 3 Mobile Commerce

- 4 Social Media

- 5 Technology and Integration Metrics

- 6 BigCommerce Stats: Customer Acquisition and Retention Metrics

- 7 Sales and Revenue Metrics

- 8 BigCommerce Merchant Metrics

- 9 Global Reach and Market Share

- 10 Revenue and Growth Metrics

- 11 BigCommerce Merchant Demographics

- 12 Platform Features and Performance

- 13 Integration and App Ecosystem

- 14 BigCommerce Stats: Customer Support and Satisfaction

- 15 Future Outlook

- 16 Dominate With BigCommerce

Sales Performance

Impressive Average Order Value (AOV)

BigCommerce merchants see an average order value (AOV) of $137. This metric is a crucial indicator of business performance, influencing revenue and profitability.

(Source: BigCommerce)

Strong Conversion Rate: 2.5%

This BigCommerce stat highlights how the platform equips sellers with the tools they need to drive growth. BigCommerce’s 2.5% conversion rate exceeds typical ecommerce conversion rates, which usually hover between 1% and 2%.

(Source: BigCommerce)

Geographic Distribution of GMV

BigCommerce’s Gross Merchandise Value (GMV) is distributed across five key regions:

- United States (44%),

- United Kingdom (12%)

- Australia (8%)

- Canada (6%)

- Germany (4%)

(Source: BigCommerce)

User Demographics

Over 50% of BigCommerce Merchants Are Younger Than 44

62% of BigCommerce merchants fall within the 25-44 year old age range. This BigCommerce stat indicates a strong presence of younger entrepreneurs and mid-career professionals leveraging the platform, potentially due to their willingness to adapt to a powerful, dynamic platform.

(Source: BigCommerce)

Over 50% of Merchants Are Male

The gender distribution of BigCommerce merchants shows a near balance, with 55% identifying as male and 45% as female.

(Source: BigCommerce)

Most Businesses Have Fewer Than 10 Employees

BigCommerce’s market share is primarily dominated by smaller businesses, with a notable 55% of companies operating with fewer than ten employees. BigCommerce is clearly an appealing choice for small businesses and startups. Brands with lean teams can fully utilize the platform’s plugin ecosystem and user-friendly tools to compensate for reduced resources.

(Source: BigCommerce)

North America and Europe Are Key Hubs

As the GMV BigCommerce stat might have indicated, North America and Europe are both primary hubs for BigCommerce stores. 44% of BigCommerce merchants are based in North America, while 26% are based in Europe.

(Source: BigCommerce)

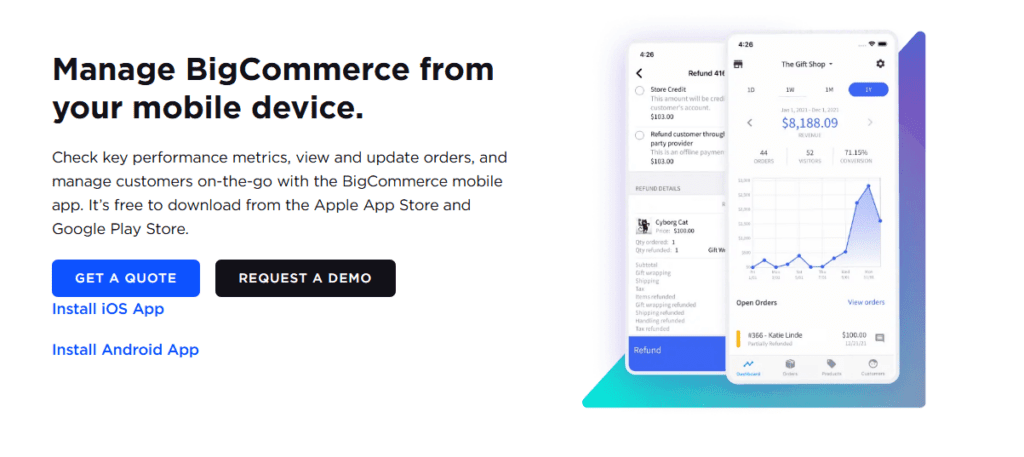

Mobile Commerce

Mobile Traffic Dominates

A significant portion of online traffic, around 63%, to BigCommerce stores comes from mobile devices. Mobile-first ecommerce web design has never been more important. Customers expect innovative designs and optimized performance before purchasing online.

(Source: BigCommerce)

Lower Conversions On Mobile Devices

Mobile conversion rates for BigCommerce stores average around 2.2%. While still representing a substantial portion of sales, this rate is typically slightly lower than desktop conversion rates. This BigCommerce stat is to be expected, as the same trend can be seen across other ecommerce platforms. Tablet and desktop conversions are generally higher due to the more accessible and optimized checkout experiences they offer.

(Source: BigCommerce)

Slightly Lower Mobile AOV

The AOV for mobile purchases on BigCommerce is $125. This figure is slightly lower than the overall average AOV of $137, suggesting a modest difference in spending behavior between desktop and mobile shoppers.

(Source: BigCommerce)

Social Media

Top Social Media Channels

BigCommerce’s market share growth has been assisted by social media marketing. The top social media channels used by BigCommerce merchants are:

- Facebook (71%)

- Instagram (55%)

- X (formerly Twitter) (35%)

- Pinterest (26%)

(Source: BigCommerce)

Social Media Traffic Contribution

12% of total traffic to stores comes from social media channels, a BigCommerce stat that highlights the importance of creating an effective social media marketing strategy. 12% might not sound significant, but it represents a massive number of visitors in terms of total traffic.

(Source: BigCommerce)

Technology and Integration Metrics

Headless Ecommerce Adoption

A substantial 30% of BigCommerce merchants have adopted headless ecommerce. Decoupling the frontend presentation layer from a store’s backend offers significant flexibility in design, and more stores are starting to recognize that.

(Source: BigCommerce)

Over 10 Billion Monthly API Calls

BigCommerce’s store and plugin ecosystem is booming. Merchants collectively generate over 10 billion API calls monthly, partly due to the platform’s open architecture and operability with third-party integrations.

(Source: BigCommerce)

Third-Party Apps Abound

Speaking of third-party integrations, it’s worth pointing out that 75% of BigCommerce merchants use at least one third-party app.

(Source: BigCommerce)

BigCommerce Stats: Customer Acquisition and Retention Metrics

Customer Acquisition Efficiency

BigCommerce merchants report an average Customer Acquisition Cost (CAC) of $50. This figure represents the average expense incurred to acquire a new customer.

(Source: BigCommerce)

Impressive Customer Retention

75% of BigCommerce merchants report a customer retention rate of 50% or higher, an impressive reminder of BigCommerce’s growing market share.

(Source: BigCommerce)

Sales and Revenue Metrics

Booming Annual Sales

BigCommerce merchants achieve an average of $250,000 in annual sales. Small businesses and startups have clearly been able to leverage the platform’s flexibility to create a consistent revenue stream.

(Source: BigCommerce)

BigCommerce Peak Season Stats

BigCommerce merchants reported peak sales during the holiday season (November-December) and during summer sales (June-August). This seasonal pattern aligns with broader retail trends, with holidays traditionally driving significant consumer spending.

(Source: BigCommerce)

BigCommerce Merchant Metrics

Over 200,000 Stores Worldwide

BigCommerce was the platform of choice for over 200,000 online stores worldwide, with most stores based in the US.

(Source: BigCommerce)

Consistent Merchant Acquisition

BigCommerce, as a platform, has reported a consistent 20% YoY growth rate in merchant acquisition. Whether it’s a first-time store or a platform migration, more merchants choose BigCommerce as their primary ecommerce hub.

(Source: BigCommerce)

Merchant Loyalty

The average BigCommerce merchant has been selling on the platform for just over 3.5 years now. This BigCommerce stat highlights the platform’s longevity and adaptability to changing trends.

(Source: BigCommerce)

A Hub For Satisfied Sellers

BigCommerce’s market share isn’t the only evidence of its growth. 95% of merchants report being satisfied with the platform.

(Source: BigCommerce)

Bigcommerce is a Top Ecommerce Platform

BigCommerce holds approximately 3.2% of the global ecommerce platform market share. This percentage ranks it among the top five platforms, alongside Shopify, WooCommerce, and Magento.

A Global Ecommerce Platform

The platform operates in over 150 countries, with a strong presence in North America, Europe, and Asia-Pacific regions.

Enterprise-Ready

According to BigCommerce stats, over 30% of BigCommerce users are mid-market or enterprise-level businesses. The platform’s flexibility makes it agile enough to cater to scaling enterprise-level brands.

Revenue and Growth Metrics

Staggering Sales Volume

In 2024, BigCommerce merchants collectively generated a staggering $34 billion in gross merchandise volume, reflecting a year-over-year growth of 18%.

Unstoppable Growth For Merchants

Enhanced tools and third-party integration support propelled growth for BigCommerce merchants in 2024, increasing 23% compared to 2023.

Booming Subscriptions

New BigCommerce subscriptions increased by 15%, driven by competitive pricing changes and new advanced features targeting evolving business needs.

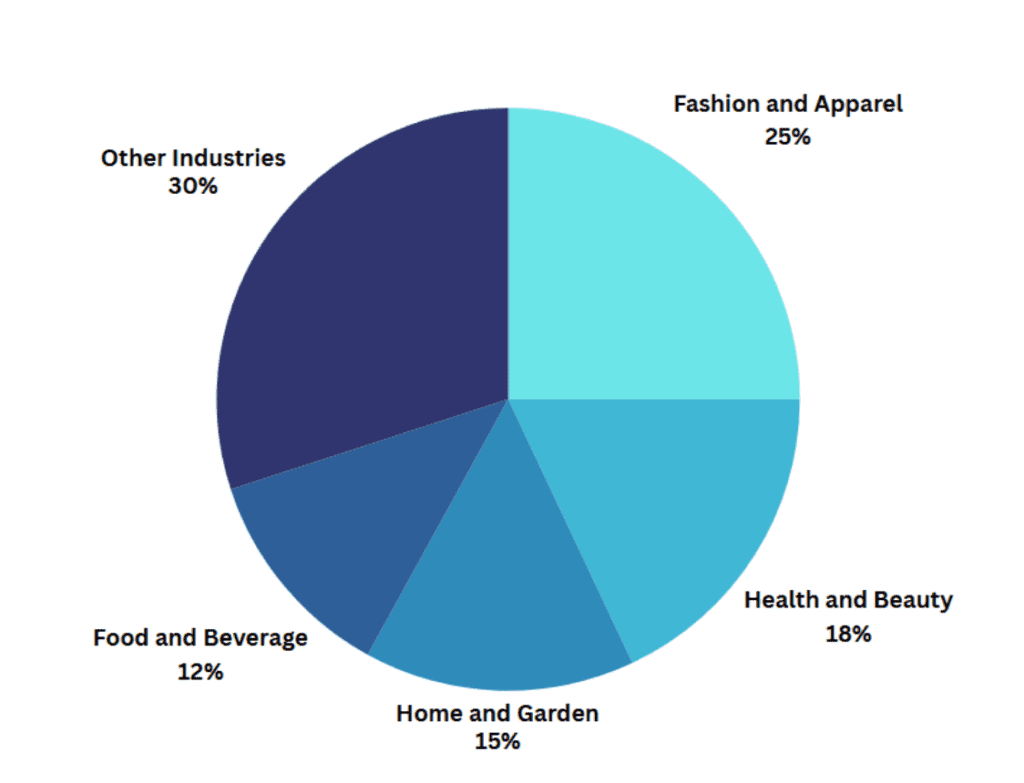

BigCommerce Merchant Demographics

Industry Segments

Fashion and apparel, health and beauty, and home and garden headed up the list of top industries on BigCommerce in 2024.

Small Businesses Choose BigCommerce

According to these BigCommerce stats, small businesses played a massive role in BigCommerce’s growing market share.

- Small businesses (1-10 employees): 50%

- Mid-market businesses (11-100 employees): 35%

- Enterprises (100+ employees): 15%

Platform Features and Performance

Page Load Speed

BigCommerce stores do not slouch in the performance department, with the average site boasting an average load time of 2.4 seconds, outpacing competitors and contributing to high conversion rates.

SEO Tools

BigCommerce merchants report a 30% increase in organic traffic after using the platform’s powerful built-in SEO tools and compatible integrations.

Payment Gateways

As of now, the platform supports over 100 payment gateways, including PayPal, Stripe, and Square, allowing merchants to cater to a truly global audience.

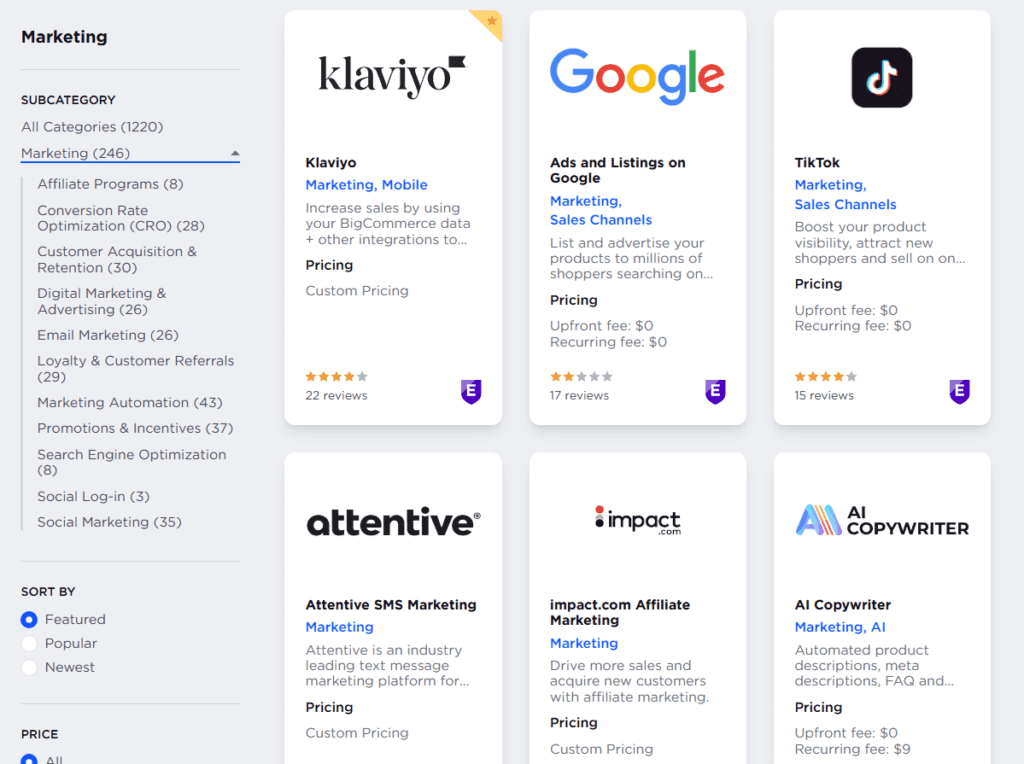

Integration and App Ecosystem

Third-Party Integrations

According to BigCommerce stats, the platform currently offers over 800 compatible integrations, including powerful tools like Salesforce, HubSpot, and Mailchimp.

Growing App Store

The BigCommerce App Store reported a 20% increase in available apps YoY, with new additions targeting marketing, analytics, and logistics.

Popular Apps

The four most popular BigCommerce apps are:

- SEO Manager: Helps businesses plan and execute search engine optimization strategies to boost their visibility and grow conversions.

- Klaviyo: Designed to simplify email marketing campaigns, helping managers segment buyers and target them with data-driven tools.

- ShipStation: This logistical powerhouse manages shipping, so you don’t have to. ShipStation automates order fulfillment workflows and helps businesses find affordable solutions.

- Facebook Ads Extension: This extension helps businesses manage their Meta ad campaigns with advanced targeting and reporting tools.

BigCommerce Stats: Customer Support and Satisfaction

Customer Satisfaction Rate

Customer satisfaction played a huge role in BigCommerce’s market share growth. BigCommerce achieved a 91% satisfaction rate in 2024, mainly due to the platform’s 24/7 live chat, email, and phone support, alongside its knowledge base and active community forum.

Merchant Feedback

According to prominent BigCommerce sellers, the platform’s user-friendly interface, scalability, support, and robust customization options were its strongest offerings.

Future Outlook

AI Integration

BigCommerce is reportedly investing heavily in AI-powered tools for personalized product recommendations and more advanced analytics.

Sustainability Initiatives

According to the latest BigCommerce stats, customers prioritize businesses committed to sustainable operations. BigCommerce is looking to support those businesses by offering integrations with carbon offset programs.

Expansion into Emerging Markets

BigCommerce plans to increase its presence in emerging markets such as Africa and South America, tapping into the rapid growth of ecommerce markets there.

Dominate With BigCommerce

The future looks bright for BigCommerce stores in 2025 and beyond. Join the rising tide of growth with an award-winning digital marketing and web design agency. Coalition Technologies has helped thousands of businesses use BigCommerce to its full potential, driving millions in annual sales. Get a free consultation today and find out what we can do for your business.